The dividends are expected to be paid out in quarterly installments and reflect positively on the company’s ability in cash generation. On February 17, WMT announced an annual $2.24 per share dividend for its fiscal year 2023, which indicates an increase of approximately 2% from the $2.20 per share for the previous fiscal year. It has a $378.50 billion market capitalization. The company operates through the three broad segments of Walmart U.S. WMT in Bentonville, Ark., is an industry giant that engages in retail, wholesale, and other unit businesses globally.

The company’s adjusted EPS beat the $1.22 consensus estimate by 8.2%.Ĭlick here to checkout our Semiconductor Industry Report for 2022

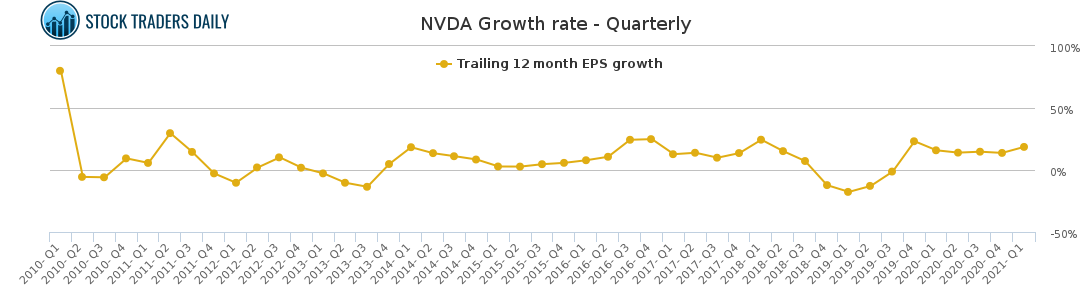

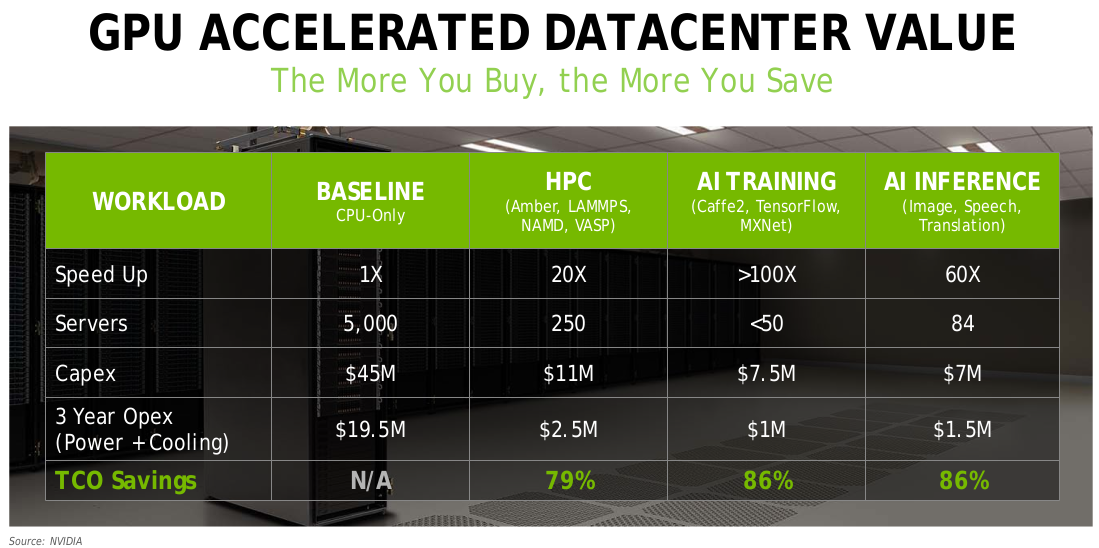

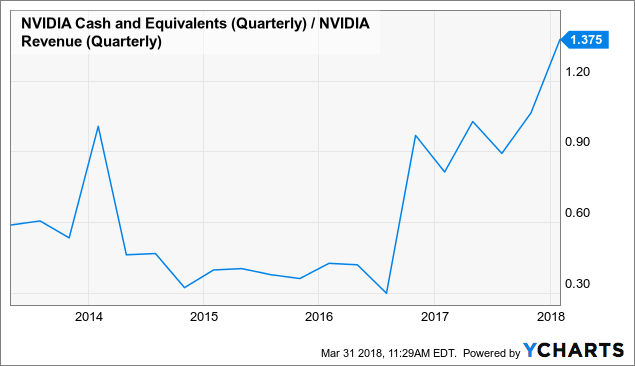

Its non-GAAP net income and non-GAAP net income per share improved 71.2% and 69.2%, respectively, from the same period in the prior year to $3.35 billion and $1.32, respectively. Its non-GAAP income from operations rose 76% from the prior-year quarter to $3.68 billion. The new products and designs might add to the company’s revenue stream.įor the fiscal fourth quarter, ended January 30, NVDA’s revenue increased 52.8% year-over-year to $7.64 billion. On January 4, NVDA unveiled more than 160 gaming and Studio GeForce ® -based laptop designs, as well as a new desktop and laptop GeForce RTX ® GPUs and technologies. NVDA should stand to benefit from this partnership. On February 16, Jaguar Land Rover announced the formation of a multi-year strategic partnership with NVDA to jointly develop and deliver next-generation automated driving systems and AI-enabled services and experiences for its customers. It has a market capitalization of $582.88 billion. The Santa Clara, Calif.-based company offers GeForce GPUs for gaming and PCS, GeForce NOW gaming streaming devices, and data center platforms and systems for AI. NVDA is a visual computing company operating worldwide under Graphics and Compute & Networking segments. Hence, we think these names might be solid additions to one’s watchlist. ( CSCO ) handily beat earnings estimates last week. The mega-cap stocks NVIDIA Corporation ( NVDA ), Walmart Inc.

The index reported more than 30% earnings growth for the fourth straight quarter and more than 45% earnings growth for the full year. According to the FactSet earnings season update, released on February 11, the number of S&P 500 companies beating EPS estimates is above the five-year average. However, corporate earnings appear to be in a solid position. In addition, the CBOE Volatility Index (^VIX) rose 4.5% intraday yesterday. The Dow Jones Industrial Average slid 482.57 points to 33,596.61, the S&P 500 fell 1% to 4,304.76, and the Nasdaq Composite declined 1.2% to 13,381.52. and Russia over Ukraine soured market sentiment at the start of the holiday-shortened week. The S&P 500 closed in the correction territory on Tuesday, as the escalating tension between U.S.

0 kommentar(er)

0 kommentar(er)